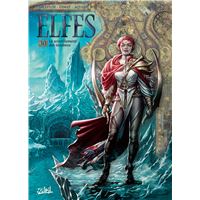

Les elfes sont des créatures magnifiques dont l’existence demeure tout un mystère. Ces êtres sont présents dans de nombreux contes, légendes et même dans le cinéma. Malgré leur apparition dans plusieurs œuvres littéraires, ils demeurent méconnus par la plupart des gens. Plusieurs livres sont proposés par des amateurs d’elfes pour enrichir vos connaissances en la matière. Cependant, le présent article vous donnera une vue plus détaillée.

Présentation de z3lf.com et description des elfes

Le site z3lf.com est tenu par Gustave qui est un passionné des elfes. Il a alors mis en place ce site pour présenter les créatures qui lui ont toujours inspiré l’étonnement et l’admiration. Selon lui, ces représentations de livres mythologiques méritent d’être connues de tous pour ne plus être que de l'imagination.

Il faut dire que les elfes sont des créatures ayant rapport aux fées. Leur apparence est semblable aux humains à la différence des oreilles et de quelques points cosmétiques. En effet, concernant leurs oreilles, elles sont plutôt pointues. Pour ce qui est de leurs traits physiques, ce sont des êtres généralement minces, élancés, blonds ayant de longues chevelures lisses. Vous en retrouverez certains aspects dans de nombreuses représentations : dans l'art, les jeux (type machines à sous), les films, dessins animés, etc.

Ces êtres possèdent une longue existence de vie qui peut s’étendre à des milliers d’années. Une fois l’âge de la maturité atteint, ils ne grandissent plus. De ce fait, ils ont une apparence éternelle juvénile. Ils ne tombent pas malades, mais peuvent mourir suite à une grave blessure ou à un chagrin extrême. Vu leur durée d’existence, ils ont une perception du monde et de la vie contraire à celle des humains.

Ces créatures ont une intelligence et une sagesse plus accrues que les humains. Ils ont des pouvoirs magiques, mais aussi une vue et une ouïe affinées. Le son de leur voix est comparable aux bruissements légers des eaux et est agréable à écouter.

Origine des elfes

À l’origine, dans la mythologie scandinave, ils étaient des génies de l’air. Ils étaient considérés comme étant des êtres divins de la nature et de la fertilité. En effet, ils vivent proches de la nature et possèdent des connaissances ancestrales sur les composants de la nature. Ils ont peu après fait leur apparition dans les histoires celtiques grâce à certaines œuvres littéraires irlandaises et écossaises.

Selon une légende d’Islande, les elfes sont les enfants des premières créatures de Dieu, Adam et Ève. Un jour, Ève était en train de laver ses enfants, mais n’a pas pu finir avant la visite de Dieu. Alors, elle cacha ceux qu’elle n’a pas pu laver. Quand Dieu lui demanda si ce sont seulement les présents qui sont ces enfants, elle répondit oui. Dieu sachant qu’elle mentait, se fâcha et dit alors que ceux qu’elle lui a cachés seront aussi cachés aux êtres humains. De ce fait, ces enfants non lavés se transformèrent alors en elfes et en fées et ne sont pas à la portée des humains.

Dans la littérature, plusieurs récits de fantasy les décrivent comme étant des personnes ayant des aspects agréables à l’œil, dotés d’une sagesse et d’une noblesse. Les experts de la fantasy les prennent pour des immortels, résidant dans les forêts et disposant de pouvoirs magiques. Dans la série Eragon de Christopher Paolini, ils sont appelés le « Beau Peuple ».

La culture des elfes

La culture des elfes est totalement contraire à celle des humains qui est souvent brutale et sauvage. En effet, la civilisation des elfes est une harmonie parfaite de plusieurs parties pour n’en former qu’une. Elle est plus sophistiquée et est en relation avec la nature. Ces créatures font face à une diminution démographique de leur population due à une faible fécondité et de leurs participations dans plusieurs guerres. De plus, il s'agit d'une civilisation très ancienne.

Les elfes et les nains ne sont pas en de bons termes. En effet, les premiers ressentent une haine contre les nains en raison de leur aspect physique. Les nains sont de petite taille, solides et opposent une résistance, contrairement aux elfes qui sont minces, élancés et fragiles.

La société des elfes suit une hiérarchie et forme une élite positionnant des individus considérés comme meilleurs à des postes de responsabilité. Elle est souvent gouvernée par un souverain (un roi ou une reine faisant partie de la noblesse). De ce fait, ils ont développé un intérêt pour la politique.

Les races d’elfes

Il existe deux grands peuples d’elfes dont les elfes lumineux vivant dans le ciel et les elfes sombres vivant ci-dessous sur la terre.

Les Elfes de la nuit

Ce sont des êtres de grandes tailles, forts et musclés faisant partie du peuple de l’alliance. Grâce à leur physique, leur force surpassait celles de leurs alliés. Leur immortalité est due à l’Arbre-Monde. Toutefois, ils l'ont perdu après le combat du mont Hyjal. Leur durée de vie est alors réduite, mais pas pour autant, car ils eurent après une existence de plus de 10 000 ans.

Concernant leurs armes, ils maîtrisent l’art de l’arc, mais disposent aussi des armes de préférence comme les glaives lunaires. Ils vénèrent la déesse de la nuit et de la lune qui, au travers de ses prêtresses, soigne leurs blessures.

Les Hauts-Elfes

Les Hauts-Elfes sont parentés aux Elfes de la nuit qui, après la destruction du Puits du Soleil, bannirent les rescapés des habitants de Quel’Dorei. Après s’être libérés des lois de ces derniers, les Hauts-Elfes fondèrent le royaume de Quel’Thalas. Ils ont ainsi abandonné l’adoration de la lune et ont contemplé la lumière du soleil en continuant d’exercer leurs activités magiques.

Pour ne pas être vus par les autres, ils bâtirent des pierres runiques aux alentours de leur nouvelle maison. Cette pierre fut détruite quelque temps après, mettant ainsi les Hauts-Elfes sans foyer. Ils se lièrent donc aux Elfes de Sang dans le but d’avoir accès à la source d’énergie bénie auprès du Puits du Soleil après qu’il soit réactivé.

Elfes du Vide

Ce sont des Elfes de Sang qui ont été bannis de Lune-d’Argent à cause de leur manipulation de l’énergie de l’ombre qui pourrait mettre en péril le Puits de Soleil. Ils se sont alors rendus dans un monde détruit par le Vide dans le but de rechercher un moyen de contrôler cette énergie.

Ils ont été traqués et retrouvés par le Prince Néant qui voudrait les réduire en esclavage. Cependant, ils furent sauvés à temps par Alleria qui décida de les former afin de lever une nouvelle armée pour l’Alliance.

Elfes noirs ou drows

Ce sont des elfes sensibles à la lumière qui s’enferment dans les souterrains. C’est un peuple particulièrement hautain avec une répulsion envers les autres elfes. En effet, étant considérés comme des aberrations, ils ont été traqués pour être exécutés. Ils ont perfectionné des armements qui rivalisent même avec ceux des Hauts-Elfes.

Ils mesurent une taille maximale de 2 m grâce à leur magie, mais sont plus rapides et plus habiles que les elfes normaux. Ils entretiennent des excellentes relations avec les nains et ces derniers les aident à forger leurs armes. Cependant, ils ne sont pas immortels. Déjà à quatre cents ans, ils ressentent de la fatigue lors de certains mouvements.